Want to dive into algorithmic trading using deep learning but feeling stuck on the math? Don’t worry—this guide is here to make linear algebra, a key piece of the puzzle, simple and clear. You’ll learn how linear algebra powers deep learning models that help traders predict stock prices or manage risks. By the end, you’ll understand the basics, see real-world examples, and feel ready to explore further—no math degree needed!

Why Linear Algebra Matters for Trading

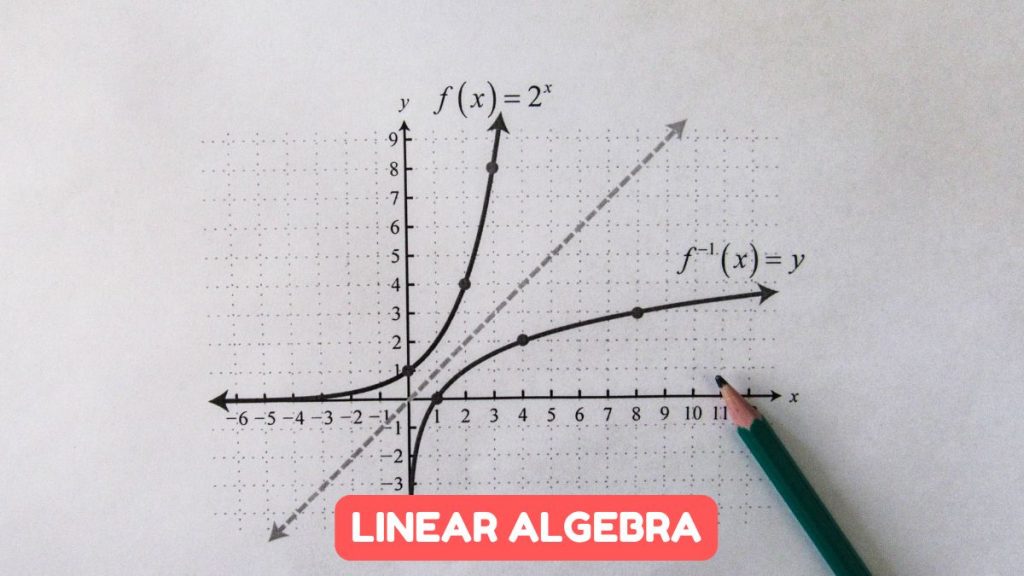

Imagine you’re trying to predict if a stock’s price will go up tomorrow. Deep learning, a type of artificial intelligence, can analyze tons of data—like past prices or market trends—to make that prediction. But deep learning needs linear algebra to work its magic. Linear algebra is like the toolbox that helps computers organize data, do calculations, and find patterns fast.

For example, when I first started learning about trading, I was overwhelmed by all the numbers—stock prices, volumes, you name it. Then I learned that linear algebra organizes this chaos into neat structures, like lists or grids, so computers can process them. Let’s break it down step by step.

Key Linear Algebra Concepts Made Simple

Linear algebra sounds fancy, but it’s just about working with numbers in an organized way. Here are the main ideas you need to know:

- Vectors: Think of a vector as a list of numbers. For example, a vector could hold a stock’s closing prices for the past five days: [50, 52, 51, 53, 54]. Vectors help deep learning models track data points like prices or trading volumes.

- Matrices: A matrix is like a spreadsheet—a grid of numbers. Imagine a matrix where each row is a different stock and each column is a day’s price. Matrices let computers handle lots of data at once, like comparing multiple stocks over time.

- Tensors: These are like matrices but with more dimensions. If a matrix is a flat grid, a tensor is a 3D cube (or more!). In trading, tensors might hold complex data, like stock prices, trading volumes, and news sentiment scores all together.

- Matrix Operations: These are calculations, like multiplying or adding matrices. In deep learning, matrix multiplication helps the model “learn” by adjusting how important each piece of data is. For example, it might figure out that yesterday’s price matters more than last week’s.

- Eigenvalues and Eigenvectors: These sound tricky but think of them as tools to find the most important patterns in data. In trading, they can help spot which market factors drive price changes the most.

How Linear Algebra Powers Deep Learning in Trading

Deep learning models, like neural networks, are like super-smart calculators that predict things, such as whether a stock will rise. Linear algebra makes these models work. Let’s look at how it’s used in trading.

1. Organizing Financial Data

Financial data is messy—prices, volumes, economic reports, and more. Linear algebra organizes this into vectors and matrices. For example:

- A vector might hold one stock’s prices for a week.

- A matrix might store prices for 10 stocks over a month.

This setup lets deep learning models process data quickly. When I tried building my first trading model, I used a matrix to store daily prices for Apple and Tesla. It made comparing their trends so much easier!

2. Building Neural Networks

Neural networks, the heart of deep learning, rely on matrix operations. Each layer of a neural network takes input data (like stock prices), multiplies it by a matrix of “weights” (numbers that show what’s important), and produces an output, like a price prediction.

For instance, a Long Short-Term Memory (LSTM) network, often used in trading, uses matrices to track patterns in time series data, like stock prices over weeks. It’s like teaching the computer to remember and weigh past trends to guess what’s next.

3. Managing Risk

In trading, you don’t just want to predict prices—you need to manage risks. Linear algebra helps here too. A covariance matrix shows how different stocks move together. If two stocks always rise or fall together, you might avoid putting all your money in both to reduce risk.

For example, I once built a small portfolio and used a covariance matrix to check if my stocks were too similar. It helped me diversify and avoid big losses when one sector tanked.

4. Simplifying Data with PCA

Sometimes, you have too much data—prices, volumes, news, and more. Principal Component Analysis (PCA), a linear algebra technique, simplifies this by finding the most important patterns. It’s like zooming in on what really matters.

In trading, PCA can help you focus on key market trends, ignoring noise like random price spikes. This makes your deep learning model faster and more accurate.

A Simple Example: Predicting Prices

Let’s walk through a basic example of how linear algebra works in a trading model.

- Gather Data: You collect a week’s closing prices for a stock: [100, 102, 101, 103, 104]. This is your vector.

- Create a Matrix: You add more data, like trading volumes, into a matrix:

Prices: [100, 102, 101, 103, 104] Volumes: [500, 600, 550, 620, 580] - Feed to a Neural Network: The neural network uses matrix multiplication to weigh this data and predict tomorrow’s price. For example, it might decide recent prices matter more than volumes.

- Optimize: Linear algebra helps adjust the model’s weights to make better predictions over time, using something called gradient descent (a fancy way of saying “learn from mistakes”).

This process helped me build a toy model to predict stock prices. It wasn’t perfect, but seeing the numbers come together was exciting!

Tips to Get Started

Ready to try linear algebra for trading? Here’s how to begin:

- Learn the Basics: Start with vectors and matrices. Online tutorials, like Khan Academy’s linear algebra course, explain them clearly.

- Use Python: Libraries like NumPy make linear algebra easy. For example, you can create a matrix in Python with

np.array([[1, 2], [3, 4]]). - Explore Deep Learning: Try TensorFlow or PyTorch for building neural networks. They handle the linear algebra for you, but knowing the basics helps.

- Practice with Data: Download free stock data from Yahoo Finance and experiment. Try turning prices into a matrix and see what patterns you find.

- Read Up: Check out Machine Learning for Algorithmic Trading by Stefan Jansen for practical examples.

Common Pitfalls to Avoid

- Overcomplicating: You don’t need to know every linear algebra concept. Focus on vectors, matrices, and basic operations to start.

- Ignoring Data Quality: Bad data (like missing prices) can mess up your matrices. Always check your data first.

- Rushing to Code: Understand the math a bit before jumping into Python. It’ll save you headaches later.

Linear algebra is like the secret sauce behind deep learning in algorithmic trading. It helps you organize data, build smart models, manage risks, and spot patterns. Whether you’re predicting stock prices or balancing a portfolio, these tools make it possible. Start small, experiment with real data, and keep learning—you’ll be amazed at what you can do.

Want to dive deeper? Try the resources I mentioned, or play with a simple Python script to create a matrix of stock prices. The journey’s worth it!