Are you curious about how to make better trading decisions in the fast world of algorithmic trading? This tutorial will explain why Bayesian Statistics is a powerful tool for algo traders. You’ll learn how it helps you stay ahead, manage risks, and create smart strategies, even if you’re new to trading or statistics. Let’s get started with a clear, step-by-step guide that feels like a friendly chat.

What is Bayesian Statistics?

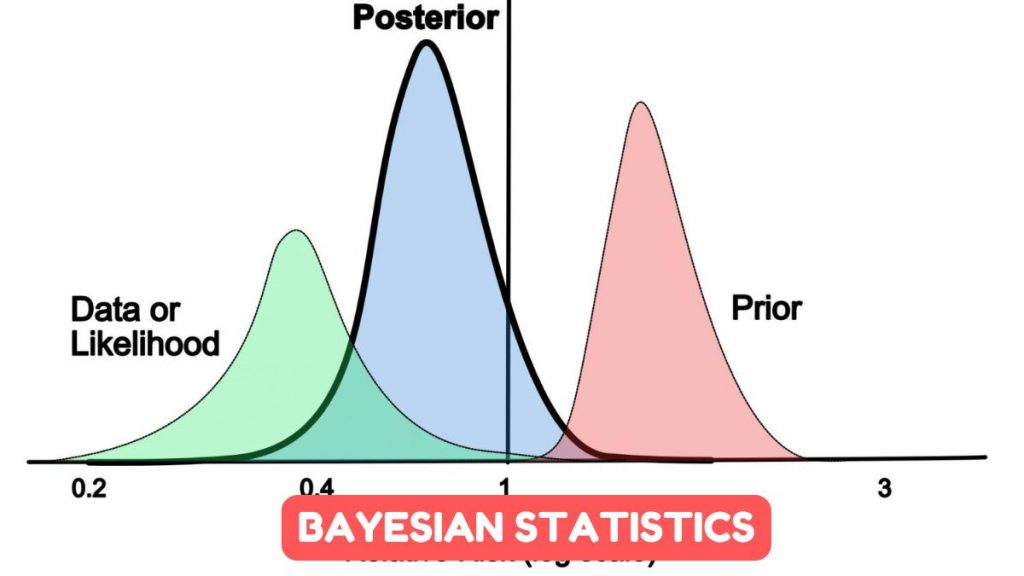

Bayesian Statistics is a way to make decisions by updating your guesses with new information. Imagine you’re trying to guess if a stock’s price will go up tomorrow. You start with a guess based on past data—this is called your “prior.” When new data arrives, like a price change or news, Bayesian Statistics helps you update your guess to make it more accurate. This updated guess is called the “posterior.” It’s like tweaking your recipe after tasting the dish to make it better.

I remember a friend who traded stocks based on hunches. One day, a sudden market drop cost him a lot. He started using Bayesian methods to rely on data instead of guesses, and it turned his trading around. That’s the kind of difference Bayesian Statistics can make.

Why Bayesian Statistics is Great for Algo Traders

Algorithmic trading uses computers to make trades super fast. But markets are unpredictable, like weather on a stormy day. Bayesian Statistics helps traders in three big ways: updating strategies quickly, handling uncertainty, and building clever trading plans. Let’s look at each one.

1. Update Strategies as Markets Change

Markets move fast. A tweet or a news report can change stock prices in seconds. Bayesian Statistics lets your trading model adjust right away by using new data. Think of it like changing your driving route when you hit traffic—it keeps you on track.

For example, if you’re trading Tesla stock and a new product announcement comes out, Bayesian methods can quickly use past data about similar events to update your predictions. This helps your strategy stay sharp.

2. Handle Uncertainty with Confidence

Trading is full of unknowns. Will a stock go up or down? Bayesian Statistics gives you a range of possibilities with probabilities, not just one answer. This helps you understand risks and avoid big losses.

Picture yourself packing for a trip. You’re not sure if it’ll rain, so you check the weather forecast (your prior) and pack an umbrella just in case. Bayesian Statistics works the same way, preparing you for different market outcomes.

3. Create Smart, Flexible Trading Plans

Bayesian Statistics lets you build trading models that learn from data and your own ideas. For example, some traders use “pairs trading,” where they trade two stocks that move together, like Apple and Microsoft. Bayesian methods can track their relationship and tell you the best time to buy or sell.

You can also customize your models for different markets, like stocks, crypto, or forex. It’s like having a toolbox that fits every job perfectly.

import numpy as np

import matplotlib.pyplot as plt

from scipy.stats import beta

# Step 1: Set your starting guess

# You think a stock has a 60% chance of going up (based on past data)

alpha_prior = 6 # Times the price went up

beta_prior = 4 # Times the price didn’t go up

# Step 2: Add new data

# You observe 3 days: 2 days the price goes up, 1 day it doesn’t

new_successes = 2

new_failures = 1

# Step 3: Update your guess

alpha_posterior = alpha_prior + new_successes

beta_posterior = beta_prior + new_failures

# Step 4: Plot the before and after

x = np.linspace(0, 1, 100)

prior = beta.pdf(x, alpha_prior, beta_prior)

posterior = beta.pdf(x, alpha_posterior, beta_posterior)

plt.plot(x, prior, label='Starting Guess (60% chance)')

plt.plot(x, posterior, label='Updated Guess')

plt.xlabel('Chance of Price Going Up')

plt.ylabel('Density')

plt.title('Bayesian Update for Stock Price Prediction')

plt.legend()

plt.show()

# Step 5: Show the new probability

mean_posterior = alpha_posterior / (alpha_posterior + beta_posterior)

print(f"New chance of price going up: {mean_posterior:.2%}")Code Explanation

- Starting Guess (Prior): We assume a 60% chance the stock price will go up, modeled with a Beta distribution (alpha=6, beta=4).

- New Data: We observe 3 days: 2 days the price goes up, 1 day it doesn’t.

- Update: The Beta distribution lets us add new data to the prior, giving an updated guess (posterior).

- Plot: The code creates a graph showing the prior and posterior, so you can see how the probability shifts.

- Result: It prints the new probability of the price going up. In real trading, you’d use more complex data, but the idea is the same: update your predictions as new information comes in.

Challenges and How to Solve Them

Bayesian Statistics is powerful, but it has challenges. It can be slow because it needs a lot of computer power for complex models. However, tools like Variational Inference or cloud computing can speed things up. Another challenge is turning your insights into profitable trades. For example, spotting a price change is helpful, but you need a plan to act on it. Testing your models with past data (called backtesting) can help you get it right.

Tips to Start Using Bayesian Statistics

If you’re new to Bayesian Statistics or trading, don’t worry. Here’s how to begin:

- Learn the Basics: Check out simple guides like QuantStart’s “Bayesian Statistics: A Beginner’s Guide” online. It’s easy to follow.

- Join Communities: Visit forums like Reddit’s r/algotrading. Traders share tips and books, like “Probability and Statistics” by DeGroot, to help you learn.

- Test First: Always test your models with historical data before using real money. It’s like practicing a song before performing it.

- Use Tools: Try Python libraries like SciPy, PyMC3, or TensorFlow Probability. They make Bayesian Statistics easier to use.

When I started with Python, it felt like learning a new language. But with practice and simple examples, it became fun. You can do it too!

Why This Matters for You

Bayesian Statistics is a game-changer because it helps you adapt to markets, manage risks, and build smarter trading plans. It’s like having a guide who updates your map as you travel. Whether you’re trading stocks, crypto, or anything else, this tool gives you an edge.

For example, traders on Reddit’s r/algotrading forum talk about using Bayesian methods to spot price changes in cryptocurrencies. One trader shared how they used it to predict Bitcoin price jumps, though they had to work hard to turn those predictions into profits. Stories like these show how Bayesian Statistics is changing the game.

Where to Learn More

Want to dive deeper? Here are some resources:

- Online Courses: QuantInsti’s Executive Programme in Algorithmic Trading (EPAT) teaches Bayesian Statistics and more.

- Books: Try “Bayesian Data Analysis” by Gelman for advanced learning or “Probability and Statistics” by DeGroot for beginners.

- Communities: Join Reddit’s r/algotrading or r/quant to connect with traders who use Bayesian methods.

Bayesian Statistics is a powerful tool for algo traders. It helps you update strategies quickly, handle uncertainty, and create smart trading plans. With modern tools and a bit of practice, anyone can use it, even if you’re just starting out. Try exploring the resources above, and soon you’ll be using Bayesian Statistics to boost your trading game. What’s the first step you’ll take to try it out?