Candlesticks Anatomy Guide for Beginners

Imagine, you’re sitting at your desk, staring at a stock chart, trying to figure out what’s going on. The lines, bars, and colors feel like a foreign language. If you’ve ever felt overwhelmed by trading charts, don’t worry—you’re not alone! Japanese candlesticks, one of the most popular tools in trading, can seem tricky at first, but they’re like a window into the market’s soul. In this guide, I’ll break down the anatomy of candlesticks in a simple, beginner-friendly way, so you can start reading charts with confidence.

What Are Candlesticks?

Candlesticks are a way to show price movements in financial markets, like stocks, forex, or commodities, over a specific time period. Think of them as little snapshots of what buyers and sellers are doing. Each candlestick tells a story about the battle between those who want the price to go up (buyers) and those who want it to go down (sellers). This method started in Japan over 300 years ago when rice traders, like the legendary Munehisa Homma, used it to track prices. It’s been a game-changer ever since.

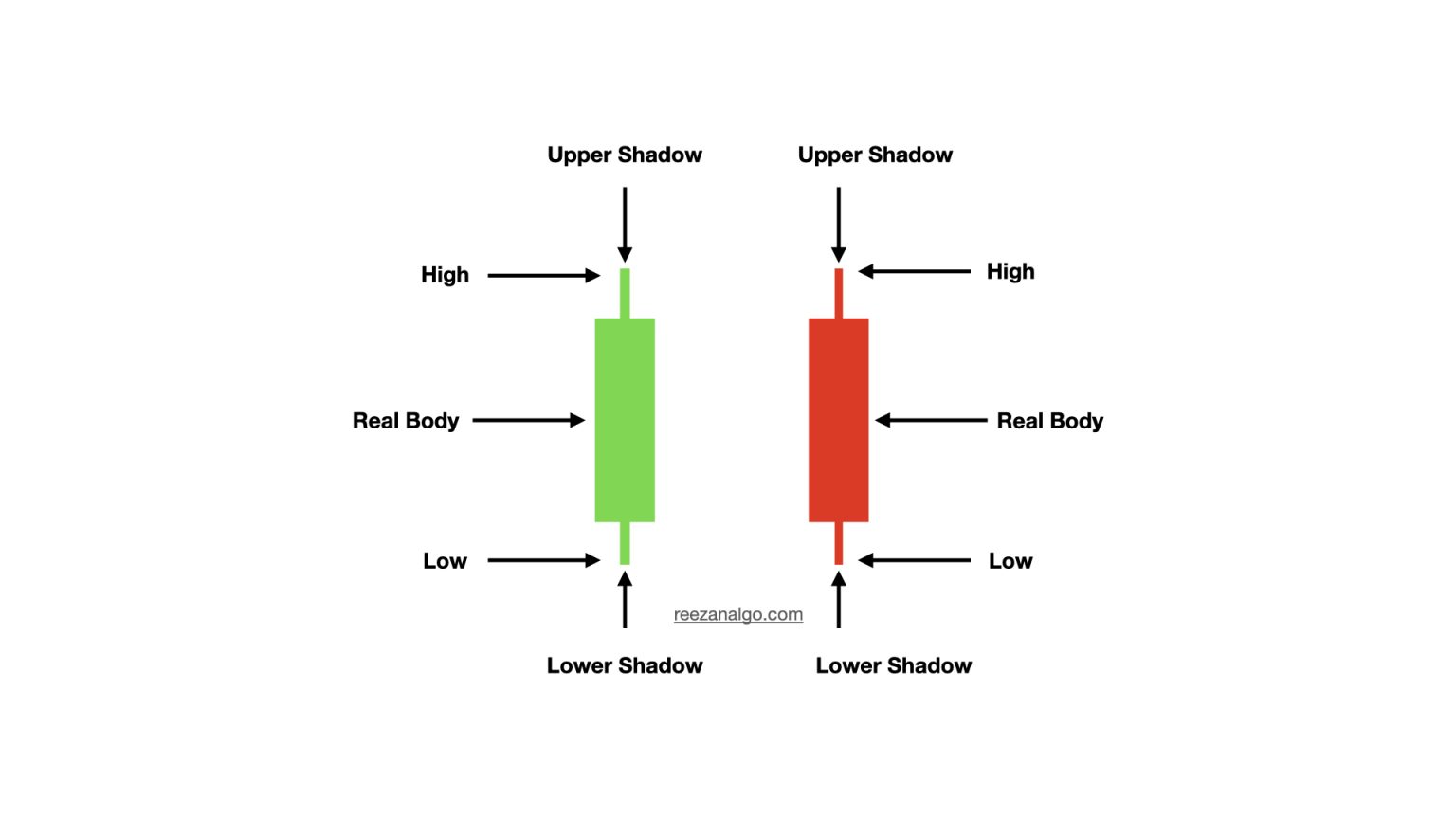

Each candlestick has four key pieces of information: the opening price, the closing price, the highest price, and the lowest price during a set time (like one hour, one day, or one week). By looking at these, you can understand how the market is behaving and make smarter trading decisions.

The Parts of a Candlestick

Let’s break down a candlestick into its basic parts. Imagine it as a person with a body and arms—or, in this case, shadows.

- The Real Body: This is the thick part of the candlestick. It shows the difference between the opening price (where the price started) and the closing price (where it ended) for the time period. If the price goes up, the body is usually white or green. If it goes down, it’s often black or red. (Don’t worry about the colors too much—different platforms use different ones, but the idea is the same.)

- Upper Shadow / Wick: This is the thin line sticking out from the top of the body. It shows the highest price reached during the time period.

- Lower Shadow / Wick : This is the line coming out from the bottom of the body. It shows the lowest price during the period.

- High and Low: The very top of the upper shadow is the highest price, and the very bottom of the lower shadow is the lowest price.

Think of the candlestick as a diary entry for the market. The body tells you who won the battle (buyers or sellers), and the shadows show how far each side pushed the price before the session ended.

Bullish vs. Bearish Candlesticks

Now, let’s talk about the two main types of candlesticks: bullish and bearish. These terms sound fancy, but they’re simple.

- Bullish Candlestick: This happens when the closing price is higher than the opening price. It means buyers were stronger, pushing the price up. On a chart, these are often white or green. For example, if a stock opened at $10 and closed at $12, you’d see a bullish candlestick with a body showing that $2 gain.

- Bearish Candlestick: This is when the closing price is lower than the opening price. Sellers took control, driving the price down. These are usually black or red. If that same stock opened at $12 but closed at $10, you’d see a bearish candlestick.

Here’s a quick tip: Don’t get hung up on the colors. Some platforms let you customize them. Focus on whether the close is above or below the open—that’s what matters.

Why Size Matters

Not all candlesticks are created equal. The size of the body and shadows can tell you a lot about what’s happening in the market.

- Long Bodies: A candlestick with a long body (whether bullish or bearish) shows strong buying or selling pressure. For example, a long bullish body means buyers were aggressive, pushing the price way up. A long bearish body means sellers were in charge, driving the price down hard.

- Short Bodies: A small body means there wasn’t much action. Buyers and sellers were in a tug-of-war, and neither side won. This often happens when the market is unsure or quiet.

Shadows are just as important. Long shadows show that the price moved a lot during the session but ended close to where it started. For example, a candlestick with a long upper shadow and a short lower shadow means buyers tried to push the price higher, but sellers fought back, bringing it down by the end. On the flip side, a long lower shadow and short upper shadow shows sellers tried to tank the price, but buyers stepped in to lift it back up.

Why Candlesticks Are a Big Deal

You might be wondering, “Why should I care about candlesticks?” Great question! Here’s why they’re so useful:

- They Show Market Emotion: Trading isn’t just about numbers—it’s about people. Candlesticks capture the fear, greed, and hope driving the market. For instance, a long bullish candlestick after a downtrend might signal that traders are feeling hopeful and jumping back in.

- They Work with Other Tools: Candlesticks are like the perfect teammate. You can use them with tools like support and resistance lines, moving averages, or trend lines to make better predictions. For example, if you see a bullish candlestick forming at a key support level, it might be a sign to buy.

- They’re Clearer Than Bar Charts: Candlesticks give you the same info as bar charts (open, high, low, close), but they’re easier to read. The visual difference between bullish and bearish candles pops out, making it simpler to spot trends or reversals.

- They Help You Understand the Big Players: Professional traders, banks, and hedge funds use candlesticks to make decisions. By learning to read them, you can get a sense of what these “big boys” are doing. Are they buying, selling, or staying out? Candlesticks give you clues.

Let me share a quick story. When I first started trading, I ignored candlesticks and focused on news and gut feelings. Big mistake! I kept missing key signals, like when a stock was about to reverse. Once I learned to read candlesticks, it was like putting on glasses for the first time—I could finally see what the market was telling me. It didn’t make me a millionaire overnight, but it saved me from a lot of bad trades.

How to Start Using Candlesticks

Ready to dive in? Here’s how you can start using candlesticks in your trading:

- Pick a Time Frame: Candlesticks can represent different time periods—1 minute, 1 hour, 1 day, etc. If you’re a beginner, start with daily candlesticks. They’re easier to understand and less chaotic than shorter time frames.

- Learn Basic Patterns: Some candlestick patterns, like the “doji” (where the open and close are very close) or the “hammer” (a bullish candle with a long lower shadow), can signal reversals or trends. Don’t try to memorize them all at once—just start with a few common ones.

- Combine with Other Tools: Use candlesticks alongside simple tools like trend lines or moving averages. For example, if you see a bullish candlestick forming at a 50-day moving average, it might be a strong buy signal.

- Practice, Practice, Practice: Look at charts on platforms like TradingView or your broker’s software. Try to spot bullish and bearish candlesticks and guess what they mean. Over time, you’ll get better at reading the market’s mood.

A Few Things to Watch Out For

Candlesticks are powerful, but they’re not magic. Here are a couple of tips to avoid rookie mistakes:

- Don’t Trade in a Vacuum: A single candlestick doesn’t tell the whole story. Always look at the bigger picture, like the overall trend or nearby support and resistance levels.

- Context Matters: A bullish candlestick in a strong downtrend might not mean much. But the same candlestick at a key support level could be a big deal. Always consider where the candlestick appears on the chart.

- Stay Patient: It takes time to get good at reading candlesticks. Don’t rush into trades just because you see a cool-looking candle. Practice on a demo account first.

Candlesticks are like a secret code for understanding the market. They show you what buyers and sellers are doing, how they’re feeling, and where the price might go next. By learning the basics—real bodies, shadows, bullish and bearish candles—you can start making sense of charts and spotting opportunities. Combine them with other tools, practice regularly, and you’ll be amazed at how much clearer the market becomes.

So, grab a chart, find a candlestick, and start decoding. It’s like learning a new language, but one that could help you make smarter trades. What’s your next step? Maybe check out a free charting platform and play around with daily candlesticks. You’ve got this!

1 Comment

Pingback: Top Forex Brokers Beginners Trust in 2025 for Safe Trading - Reezan Algo